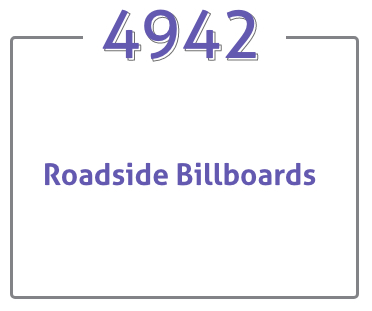

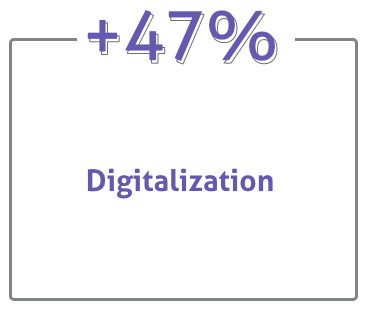

Over the past four decades, the Company successfully led the outdoor advertising sector in Saudi Arabia, bringing the latest advancements and technologies to the local market. AlArabia is a true innovator and a key influencer in the Saudi advertising sector with its strategy to continuously modernize its product and service offering. Recent global trends towards digital solutions in advertising provided another opportunity for the Company to change the way that the streets of Saudi Arabia interact with its population. These technologies further enrich the experience of living in Saudi Arabia and benefit our clients and the national economy. AlArabia is at the forefront of Saudi outdoor digital advertising, and its longstanding relationships with premium advertisers nationwide and its achievements and its successes contribute to its revenue and profit growth. We have a mission to perpetually enhance our operational efficiencies and remain performance-focused. The initial public offering (“IPO”) of AlArabia represents a key milestone along the corporate and business evolution of the Company. Going forward, the Company will continue to develop its presence in the traditional and the digital media and stay ahead of the latest developments in the advertising industry.

Mohammad Alkhereiji

CEO STATEMENT

KEY DATES FOR SUBSCRIBE?

Start of Institutional Book Building

close of the Institutional Book Building

Announcement of offer Price

Deadline for Submitting Institutional Subscription Forms

Start of Retail Offer

Last Date for Institutional Investor Funding

Final Allotment of Shares and Refunds to All Subscribers

Trading Date - Based on Regulatory Timelines

Close of Retail Offer

HOW TO SUBSCRIBE?

The subscription is limited to two tranches of investors, namely:

Tranche (A) Participating Parties

This tranche includes public and private funds that invest in securities listed on the Saudi Exchange (Tadawul), authorized persons licensed by the Capital Market Authority (CMA) to deal in securities as a principal, clients of a person authorized by the CMA to conduct managing activities, legal persons allowed to open an investment account in the Kingdom of Saudi Arabia and an account with the Depository Centre, including foreign legal persons who are allowed to invest in the market where the shares of an issuer are to be listed, government entities, any supranational authority recognized by the CMA, the Exchange, or any other stock exchange recognized by the CMA, or the Depository Center, government-owned companies, whether investing directly or through a portfolio manager, as well as GCC companies and funds, if allowed according to the terms and conditions of such funds.

The subscription is limited to two tranches of investors, namely:

This tranche includes natural Saudi persons, including a divorced Saudi woman or a widow who has minor children from a non-Saudi husband, as she is entitled to subscribe in her name or the names of her minor children for her benefit, provided that she submits evidence that she is divorced or widowed and the mother to the minor children, and any non-Saudi natural person residing in the Kingdom or citizens of the Arab Gulf Cooperation Council countries who have a bank account, and are entitled to open an investment account, with one of the Receiving Entities. The subscription of the person subscribing in the name of his divorced wife shall be null and void, and the law shall be applied against the Individual Subscriber who submitted the application if it is proven that such an operation has been carried out. In the event that the subscription is carried out twice, the second subscription shall be considered null and void and only the first subscription will be taken into consideration.

Subscription method for participating parties:

Participating Parties must submit requests to purchase the Offer Shares during the book-building period by filling out and submitting the Application Form. Participating Parties may change or cancel their Application Forms at any time during the book-building process, provided that such change is made by submitting an amended or additional Application Form (where applicable), prior to the determination of the offer price, which shall take place before the start of the Offering Period. The number of Offer Shares to be subscribed to by each Participating Party shall neither be less than one hundred thousand (100,000) shares nor shall be more than two million, four hundred and ninety-nine thousand, nine hundred and ninety-nine (2,499,999) shares. Public investment funds only shall not exceed the maximum amount specified for each participating fund, determined in accordance with Book Building Instructions. The number of ordered shares shall be allocable. The Bookrunner will notify the Participating Parties of the Offer Price and the number of Offer Shares initially allocated thereto. Subscriptions by Participating Parties shall commence during the Offering Period, which also includes Individual Investors, in accordance with the subscription terms and conditions detailed in the Subscription Application Forms.

|

|

|

|

|

|

|

|

|

FINANCIAL ADVISOR

Financial advisor, Lead Manager, Bookrunner and Lead Underwriter.

CO-UNDERWRITER

Co-Underwriter

RECEIVING AGENTS

KEY INFORMATION

The Capital Market Authority announces the Approval of the Initial Public Offering of Arabian Contracting Services Company.

The Capital Market Authority (“CMA”) Board has issued its resolution approving Arabian Contracting Services Company’s (“the company”) application for the offering of (15,000,000) shares representing (30%) of the Company’s share capital. The Company’s prospectus will be published within sufficient time prior to the start of the subscription period.

The prospectus includes all relevant information that the investor needs to know before making an investment decision, including the Company’s financial statements, activities and management.

The Capital Market Authority (“CMA”) Board has issued its resolution approving Arabian Contracting Services Company’s (“the company”) application for the offering of (15,000,000) shares representing (30%) of the Company’s share capital. The Company’s prospectus will be published within sufficient time prior to the start of the subscription period.

The prospectus includes all relevant information that the investor needs to know before making an investment decision, including the Company’s financial statements, activities and management.

A subscription decision without reading the prospectus carefully or fully reviewing its content may involve high risk. Therefore, investors should carefully read the prospectus, which includes detailed information on the company, the offering and risk factors. Thus, providing potential investors the ability to evaluate the viability of investing in the offering, taking into consideration the associated risks. If the prospectus proves difficult to understand, it is recommended to consult with an authorized financial advisor prior to making any investment decision.

The CMA’s approval on the application should never be considered as a recommendation to subscribe in the offering of any specific company. The CMA’s approval on the application merely means that the legal requirements as per the Capital Market Law and its Implementing Regulations have been met.

The CMA’s approval on the application shall be valid for 6 months from the CMA Board resolution date. The approval shall be deemed cancelled if the offering and listing of the Company’s shares are not completed within this period.

Arabian Contracting Services Company (“Alarabia”) Commences the Book Building Process Today. Share Price Range is set between (90) and (100) Saudi Riyals.

For more information, click here.

Interview with the CEO of Arabian Contracting Services with AlArabiya Channel

FAQ (FREQUENTLY ASKED QUESTIONS)

The company current shareholders are Abdelelah Abdulrahman Alkhereiji, Engineering Holding Group Company and MBC Holding Group Company Ltd.

Subscription in the offering shares is limited to two tranches of investors: Tranche (A) Institutional Investors: This tranche includes categories that are entitled to participate in the book building process, in accordance with book building instructions, and Tranche (B) Individual subscribers: This tranche includes Saudi natural persons, including the divorced or widowed Saudi woman who has minor children from marriage to a non-Saudi husband, and has the right to subscribe for her benefit in the names of her children, provided that she submits proof that she is a divorced or widowed woman, and is the mother of the minor children. This is in addition to GCC natural persons and residents living in KSA under a legal residence identity and have a bank account.

– One hundred thousand (100,000) shares for institutional investors.

– Ten (10) shares for individual subscribers.

You may refer to the prospectus available on the websites of the Capital Market Authority, the Financial Advisor, GIB Capital or the company.

The final allocation process and refund of excess money will be announced no later than 29/3/1443 H (corresponding to 4/11/2021 G).

Fifteen million (15,000,000) ordinary shares, representing 100% of the total Offer Shares.

The offer shares represent 30% of the company capital.

GIB Capital, the Financial Advisor, Lead Manager, Bookrunner and Underwriter of the IPO is the party authorized to answer queries.

Email: [email protected]

Tel: +966 11 834 8400

The major shareholders shall be subject to six (6) months lock-up during which they are prevented from disposing of their share. The lock-up period will start from the date trading of shares has started in the Saudi Stock Exchange (Tadawul). The major shareholders may not dispose of their shares during the above period.

The company’s shares will be listed on the Saudi Tadawul Group (Tadawul).

ENQUIRIES

For more information and inquiries, please contact the Financial Advisor:

GIB Capital, the IPO Financial Advisor, Lead Manager, Book runner and Underwriter.

Website: www.gibcapital.com

Email: [email protected]

Tel: +966 11 834 8400